Back to Blog

Quickstart Visual Business Planner

01 Aug 2020 · v1.1.0

Writing a good business plan is not so easy. The Visual Business Planner can help you with this. It has the advantage that you don’t have to work out everything in a spreadsheet yourself. It also shows you the result immediately in a chart. With that you can see everything on one page and also discuss it with third parties.

The Visual Business Planner is designed so that you can work with it very quickly. This is achieved by help of so-called parameters that generate all monthly values. So you only need to enter a few planning parameters and your business plan is already done. After a short time and with a little practice you can work incredibly fast. You do not need to any longer laboriously manage tables of numbers in a spreadsheets. The Visual Business Planner wants to help you that your business plan lives which means, that it can be adapted in the shortest possible time and, thus, does not sit forgotten on your hard drive.

Here, now, is a (moderately short) quickstart guide. It makes sense that you open the Business Plan tab in a parallel tab to this one in your browser.

-

Handling

It is best to first familiarize yourself with the handling.

-

Set the language to EN or DE.

-

There is a BASIC and ADVANCEd mode, choose BASIC.

-

You can enter parameters in all underlined input fields. You can complete the entry with OK or with the Enter key ↵.

-

If the parameters for the first and last months have the same value, it is sufficient to only enter the first month and the last months changes automatically to the value of the first month.

-

You can click on the ’-’ at the ‘from-to’. That changes the minus sign into a curve. Instead of a linear development from the ‘from’ value to the ‘to’ value there is then an exponential development. The difference can only bee seen if the two values differ significantly, so e.g. 1-100.

-

You can also click on all overlined fields. This changes the unit.

-

If you enter a value in a format that is not accepted, the expected input format will be displayed.

-

Next to the term Business Plan there is a ’+’ sign. If you click on it, you enter the multi-product mode. You can then plan up to three different products separately. But that’s more like something for later.

-

The bigger your screen is, the easier your planning will be. This is because then you keep track of things all on one page. If you do not see everything on one page you may want to think about reducing the zoom value of the browser. Later in the ADVANCED Mode, it is best when you see two columns side by side.

-

-

Business Plan

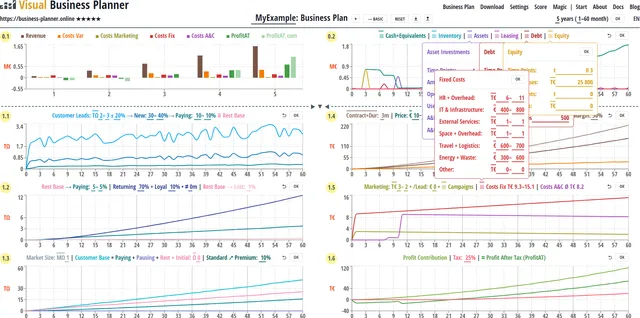

- In the top chart you can see the Business Plan. It gives you all central financial values: Revenue, Variable Costs, Marketing Costs, Fixed Costs, Profit after Tax, the Accumulated Profit after Tax over all the years. You can then choose the time period for your business plan. If you make a profit, the dark green background bar points upwards, if you make a loss it goes down. The light green bar shows the total of all profits and losses. In the first year that the light green bar is pointing up, you are Break Even. Choose at least 3 years for your Business Plan. If you don’t start in January, you can also set the starting month in the first year. In addition, you can also enter a name for your startup company.

-

BASIC mode

-

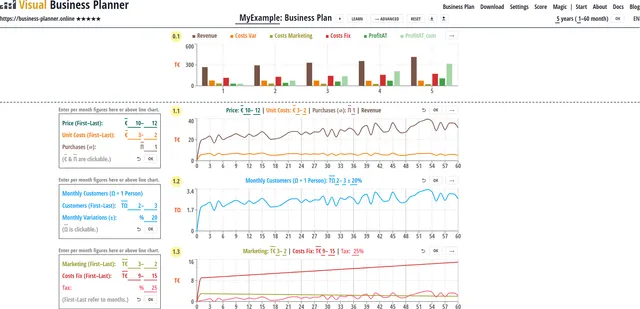

Choose a price for your product. If you plan to increase prices you can choose different prices for the first and the last months.

-

Enter the unit costs for your product.

-

If you have have not one product, but a bundle, put the average Revenue per month per customer that you expect into Price. For the unit cost then please take also the corresponding Product (Unit) Costs. If your customers buy several products per months you can pick a larger number than 1 in Purchases.

-

Next, deal with the monthly costs. What are the fixed costs you have per month for salaries, rent, IT, laptops, travel, presentations, services etc. Even if you and your co-founders are at the beginning not paying salaries to yourselves, still add salaries so you can see if your business model »works«. You should use as salaries what you would otherwise expect as an employee.

-

If you make a profit, you also have to pay taxes. 25%-30% are a first good assumption. Of course, if you make a loss, you don’t pay any taxes. Nevertheless, the Visual Business Planner shows you negative taxes, because you can deduct them later from the taxes on the profits. This is called loss carry forward.

-

Now you should also plan what you want to spend for marketing and marketing material. This, of course, also includes the website or an online shop. Advertising campaigns through Social Media are also not cheap. Find out e.g. about the prices for Google Ads to achieve a well-founded assessment.

-

Finally you have to insert the paying customers (Ω). At the beginning you will likely have fewer customers per month than at the end of your business plans. In addition, there will always be a certain variation around the expected mean value. You can also choose this variation. 10%-20% are not unrealistic.

-

Now look at the top chart 0.1. Are you making a profit or a loss? If you lose money, you either have to get more customers or you have to increase the price. When you make an assumption about more customers, remember that you probably have to increase your marketing costs. It is important that you can credibly explain how you will attract customers.

-

If you make a profit, nothing should stop you from taking off.

-

-

ADVANCED mode

-

The BASIC mode is only for beginners and for a first trial. If you want to plan in much more detail or if your business model is more complex, you need the ADVANCED mode. So please click on ADVANCED.

-

The ADVANCED mode may look a bit complex at first, but you will get used to it quickly. The advantage is that you see everything on one page and that way you can plan pretty well.

-

Many options are offered in the ADVANCED mode. Take a step-by-step approach. Always remember: to do everything in a spreadsheet yourself will take much longer. It is worthwhile to invest some time into your planning. After all, you want to convince others from your business idea and your business model and possibly also to get some funding. This is usually only possible with a good business plan. Besides, you don’t want to spend a lot of time and money on something that does not even »work« on paper. So, plan first, then implement.

-

The customer is at the core of the Visual Business Planner. You want to sell your product to him.

-

As in the BASIC mode, you can enter the price and unit costs of your product. If you have a premium version of your product as a supplement, you can enter this as well. The premium values are behind the angled arrow ↗︎. If your product is not only offered as a ‘purchases’ but also as a subscription, you can click on ‘purchases’ and switch to ‘contract+duration’. Then choose the typical contract duration. Later you can add further income and cost components under ’≣ Other’.

-

Next, take care of the costs again. In comparison with the BASIC mode you can this time enter your fixed costs in detail. To do this, click on the ’≣ Fixed costs’ and select the appropriate amounts in the pop-up window. You can close the pop-up window by clicking again on the ’≣’ symbol.

-

Now the ‘A&C costs’ remain. You cannot adjust anything here. ‘Costs A&C’ stands for Costs from Assets & Capital. These arise automatically later when we take loans or make investments.

-

Now turn to marketing costs. You already got to know the general marketing costs in BASIC mode. In addition, you can now enter costs for the acquisition of a potential customer after the ’/ Pot:‘. ’/ Pot’ stands for per Potential Customer.

-

You can later enter campaigns in the ’≣ Campaigns’ popup. But before that we want to dedicate ourselves to the topic of Conversion.

-

Conversion is the magic word when it comes to dealing with customers. You want to convert an interested potential customer into a paying customer. Or you want to convert an existing non-paying customer into a paying customer. You want to convert a paying customer into a returning paying customer.

-

The Visual Business Planner is structured accordingly. It gives you the opportunity to plan with all possible Conversions. In principle, there are two sales strategies at the extremes: In the first extreme, a company only lives off new customers. Usually it doesn’t know its customers, i.e. these are not in any of the company’s databases. So the company has to constantly win new customers. This is e.g. the case if you sell your product through intermediaries. At the other extreme, a company only lives off existing customers. So the company builds up its customer base and tries to use this customer base to generate paying customers. Every new customer is added to the customer base. For this sales strategy, companies have to »know« their customers to some extent, i.e. have a link with them.

-

The Visual Business Planner is structured accordingly. You can plan the new customers in Chart 1.1. This results in a base that can be dealt with in Chart 1.2. You win new customers from potential customers who you usually interest in your product through marketing. In some business models, all new customers are also paying customers. In this case ‘New’ can be set to ‘100-100%‘. In the event that interested customers first have to register in a shop or a platform, you can choose a corresponding percentage for new customers and also specify how many of these also immediately become paying customers.

-

The Visual Business Planner differentiates between paying customers and the customer rest base. All new customers who do not become paying customers immediately come to this rest base. In the future, further paying customers can possibly be won from the rest base.

-

Hopefully paying customers will come back after their ‘purchases’ or at the end of their ‘contract+duration’. Of course, that depends on whether there is still a need for and whether the customer is satisfied with the product. In any case, returning customers are customers who, as paying customers, buy again with a specified probability and then again and again with the same probability. In addition, there may be a special group of paying returners among the payers who loyally buy again and again after making a purchase. So this group never breaks down. Even if returners or loyal customers buy again, they may not need the product every month, but e.g. only every 3 months. In this case, they pause for 2 months. This pausing time can be entered after the inequality sign ≠. At the end of the planning of the customer base, you must realistically expect that you will always lose part of your customer base every month. These customers leave the database and are thus lost for the company.

-

Chart 1.3 summarizes the development of the customer base in the various groups (payer, pausing, rest+initial). Many companies are already generating significant value from a large customer base, even if they are not yet profitable. In this chart you can also enter a value for an initial customer base. An initial customer base is when you start with a customer base because you have already built it up in the past. You can also set here how many of your paying customers may choose the premium instead of the standard product. Prices and costs for a premium product have already been set above.

-

With the understanding of the customer base, we can now also take care of other income and other costs. You can find this under ’≣ Other’. Here you can enter ‘Other Income per Paying’ customers per month and ‘Other Income per Non-Paying’ customers. These entries help you with business models in which non-payers receive advertising, for example. Finally, you may have certain costs per customer, e.g. through certain administrative costs. If you make your sales through an intermediary or another third party, you have to submit a margin from your sales. Typically this is between 20-40%, depending on the product and trade. Do some research and don’t make unrealistic assumptions. The channel to the customer usually is costly.

-

If you want, you can now think about campaigns again. You can try out which campaigns work and make the most sense. The results of the campaigns with regard to additional potential customers or further Conversions and the associated costs are automatically added to the corresponding time series.

-

As in BASIC mode, you have been monitoring chart 0.1 the whole time. As usual, there is the summary of the business plan. The most important bar is the dark green bar that represents profit after tax. But the other bars also give you a lot of information. For example, you can see how sales relate to your costs. The difference between sales and variable costs is called the profit contribution. As the name suggests, it serves to cover the fixed costs. The profit contribution is shown again in Chart 1.6. If the profit contribution is not enough to cover the fixed costs, you have to sell more, increase the price or reduce the fixed costs.

-

Now is the time when we have to deal with balance sheet items. These are shown in Chart 0.2. The most important curve is in dark green and shows you your liquid funds. If the curve goes below zero, you have a real problem and may become insolvent, unless you can still get cash from somewhere to pay your bills.

-

If you have more costs than income at the beginning of your startup, you can only operate services if you have financial support or funding. Financing usually comes in the form of equity or a loan from a bank. You need financing especially if you want to make large investments, e.g. the purchase of equipment or the development of software by third parties. For special cases you can also plan leasing contracts here. Should you plan a startup that e.g. is in the Food area a lot of working capital may be required for the pre-financing of the products. For such cases you can think about how many months of the expected sales have to be pre-produced into the warehouse and enter this value into ‘Inventory’.

-

Another note on input: For the balance sheet items, you can usually enter several values one after the other, separated by spaces. This enables you, for example, to take out several loans or to make several investments. It is only important that you enter the parameter values in the individual lines in such a way that they all relate to the corresponding timepoints.

-

-

Analysis and value

-

If you want to continue reading now, we can next turn to the topic of analysis and value. To do this, click on the small down pointing triangle ‘▼︎’ and an area with numbers will open. The central table is in the middle. Here you can see important analysis metrics that will help you optimize your startup. On the right side you can see a stripped-down balance sheet with a summary of the most important positions. All displayed numbers are part of the basic repertoire and will help you when trying to find an investor. Every investor will usually want to look at these values.

-

The Visual Business Planner also gives you an initial indication of what your company could be worth. However, this number should be used with caution and you need to understand how it comes about. The basis for determining value is the consideration of a fair deal. I give you money, you give me your company. So how much money do I have to give you for the deal to be fair? If I get your company, this company will generate Cash for me now and in the future. The pros call this Free Cash Flow (FCF) . So if your company generates € 5 million FCF for 10 years and then ceases to exist, then the fair value is € 50 million first of all. Now we have to correct this 50 million. The further the FCF is in the future, the lower is its present value today.

-

To calculate the present value, you can enter the financing interest rate for your start-up. One percent equals 100 basis points (bps): 1% = 100bps. The higher the financing rate, the more the future FCFs are discounted, the lower the enterprise value.

-

As a buyer, I also run the risk that the FCF will dry up in the future. That devalues the company. On the other hand, there is also the possibility that the FCF will increase. That would then be beneficial for the buyer and increase the value of the company. Obviously, that’s more likely if the company has shown good growth over the past few years. The Visual Business Planner only uses the years of the time horizon to calculate the Enterprise Value. Usually the FCF continuous beyond that. Everything that comes after that can be included in the so-called final value. There is a formula for determining a final value, the so-called Terminal Value which is a perpetual annuity. With this one assumes that the last FCF is generated for all time. You have to decide for yourself how realistic this assumption is for your startup. All of these considerations can now be incorporated into the formula for determining an equity value and this provides a starting point for negotiations about a purchase price. In addition to this method based on Free Cash Flow, there are a few other methods that are based in particular on so-called Multiples, but the determination of value is not the task of the business planner. Nevertheless, you should take a look at this once you get a feel for the value of your startup.

-

-

Download and parameter values

-

You can download all parameters of your business plan into a parameter file and then upload it again later. For this there are two arrows next to the RESET button on the page header. This feature helps you to manage multiple versions of your business plan or to share it with third parties.

-

In the download area, you can also download the time series of your summarized business plan into a CSV-file e.g. for further processing in a spreadsheet. The CSV-file will also contain the parameter values for reference purposes.

-

The parameter values you entered remain persistent in the memory of your browser. That way, you can pick up where you left off.

-

-

Addendum: even more complex business models

-

If your business model is even more complex, the Visual Business Planner will still not let you down. If you click on the ’+’ next to ‘Business Plan’, a new line will appear. In addition to the existing product, you can plan two more products with its own customers. This enables very elaborate business models to be mapped. The variable costs appear per product, but the fixed costs of the company as well as the capital costs and costs from assets must be allocated to the individual product lines. This is called ALLOCATION and you can do this accordingly.

-

Finally, you can also plan with network effects. You can switch these ‘on’ or ‘off’ with the switch ⇍ | ⇐. Network effects usually have a positive effect on a company. The assumption of network effects is that new customers result in more new customers. You can enter this in the form ’x: y / z m‘. x new customers attract y additional customers over a period of z months. There is also another form of network effect. These are multiplier effects. A new multiplier (e.g. cooperation partner) x brings y additional new customers over a period of z months. To do this, you have to create a second product line in which you plan the multipliers. Then you can enter the values as before. From the second product line, the switch ⇍ | ⇐ | ⇑ has a third state. In state ⇑, the additional new customers created due to the multiplier effect are added to the product line above. That sounds more complicated than it is. The best thing to do is to try it out if you need this function. Tip: Use simple numbers (like 1, 10, 100, or 1000) that will help you understand how the calculations go before you start planning actual numbers for your business.

-

-

Feedback: You are welcome to write to prof.anders@online.de in the event that

-

that you will not get any further, although you have studied the Docs on the Visual Business Planner intensively,

-

that you are missing information in the documentation,

-

that you miss an essential function or an important parameter that is necessary for your business plan,

-

that you want to make a good suggestion,

-

that you have discovered an error or an inconsistency,

-

that you want to send your business plan as feedback or for viewing.

-