Docs on the Visual Business Planner

What is the Visual Business Planner ?

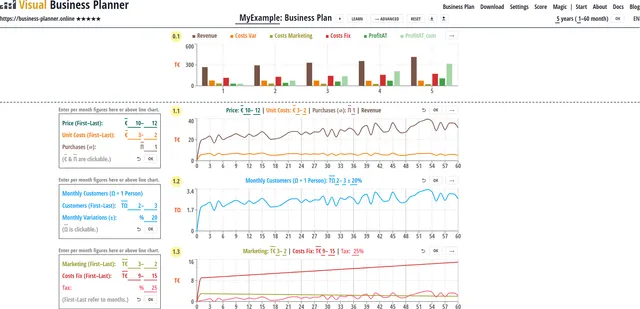

The Visual Business Planner is a free to use Web-App that helps you to produce even advanced business plans in a short time. With it you can validate product ideas and business models. It works interactively, removes complexity through the online use and displays all results graphically for easy interpretation. It is responsive but it has more options and it is easier to use on screens which are larger than a smartphone.

With the Visual Business Planner you can build a comprehensible and visually supported business plans much faster than with your own spreadsheet. It manages the complexity from recursions and interdependencies between variables that you will otherwise undoubtedly face. With its many parameters and options the Visual Business Planner will fit most business models. And best, the tool is Business School proven.

By help of the Visual Business Planner you can test your business model. You can see if it is working and sustainable. A good plan will give you orientation. A plan is always made under assumptions and these assumptions will most certainly change over time. That means, you will have to plan and re-plan and your business plan must be alive and support you in your business decisions. Making a good business plan also takes some work, but if you cannot get things working in your plan you will certainly not get things working in reality.

Read the documentation below or jump right into the Visual Business Planner by clicking on the Business Planner logo, the Business Plan menu item or one of the images below. Now, go ahead and have great success!

Why use the Visal Business Planner ?

-

Clarify your product and business ideas before you start.

-

Interactively play around with your ideas to consider them from all angles.

-

Find guidance to get through the difficulties of creating a business plan.

-

Plan in detail and realistically — reflect even advanced business models.

-

Have certainty that your plan contains the necessary parameters.

-

Remove spreadsheet complexity when making business plans.

-

Use expert knowledge built into the app instead of re-inventing the wheel.

-

Go from simple to complex and use a step-by-step approach.

-

Use simulation of average, worst and best case scenarios to know what can happen.

-

Challenge your business model. See what pre-requisites need to be met.

-

Make assumptions and effects transparent to third parties.

-

Bring your data to life by showing them in interactive charts.

-

Go ahead and have great success!

Hints

-

Visual Business Planner is free, online and requires no login.

-

Confidentiality is built-in. This means your business data are staying on your local device and never go to a central server.

-

Take screenshots for your pitchdecks. Demonstrate, evaluate and discuss interactively or in front of interested parties.

-

Select English (EN) or German (DE) for the Business Plan.

-

Check out the red explanations that will come up. More explanations appear if you click on or hover over the corresponding headings or yellow buttons. Read the docs below for all the details and definitions.

-

When you are in the Business Plan window, type in your business parameters in the UNDERLINED fields. Click on the OVERLINED fields to switch units.

-

When you click on a ’–’ between two parameters you can switch between a linear and exponential development.

-

Download all parameter into a parameter file. You can share this file with another person and this person can upload the parameter file in order to re-create all time series.

-

Download all essential time series for further individualization and quality assurance.

-

Go to settings to set your own color scheme to fit your corporate identity.

Purpose & Concept

Purpose

The Visual Business Planner fulfills one purpose: it shall help people, entrepreneurs, founders, to-be-founders, project managers and other interested people in the context of enterprises, projects, businesses or startups to make a business plan. The business plan can be achieved with a few parameter inputs. It will help to plan not only the financial data, but also customer data and marketing costs. The Visual Business Planner may help to turn an initial product idea into a feasible product innovation.

The Visual Business Planner can also help you to explore various ideas about the business model of your startup. It can, furthermore, be used as part of a pitch to a venture capitalist or other capital provider, since you can demonstrate the development of your business interactively and simulated different cases.

Underlying Concept

The idea for this Visual Business Planner goes back a number of years into the year 2016:

-

Startup founders as well as company owners or managers who need to produce a business plan, normally face the challenge that they want to calculate the break even point or future profits of their startup or company. For this they typically take Excel, they are setting a price for their product, trying to make some estimates about the revenue and then about their costs. However, in many cases they get stuck, when some more detailed planning becomes necessary. And very fast, the Excel sheet will become very complex and difficult to handle, especially when it comes down to planning the development of customer bases, subscription models, variable costs, marketing costs and results, or network effects.

-

There are a number of alternative business planning tools or Excel templates out there. But most suffer from the problem, that they want you to plan revenue and costs directly. They do not recognize that revenue and costs are resulting numbers typically measured at the end of a period. For planning purposes you need to centrally look at customers. How many customers can you reach, how many customers make a purchase, how many of the customers you do already have return and so on. Not putting the customer into the center of all planning is a big mistake.

-

The Visual Business Planner puts the customers in the centre of all reasonings. The customer will purchase the products, or enter into contracts . Purchases and contracts are connecting the customers with a product and its price. The financials then result from applying these data.

General Information

Status

After years of developing and testing in the alpha and beta-phase, the Visual Business Planner is now in the rc — release candidate state. The term rc means, that there will not be frequent changes to the Visual Business Planner. The Visual Business Planner has been properly tested and re-tested. There is a high level of confidence that the calculations are correct given the simplifying assumptions that the Visual Business Planner is making. But there may still be bugs. So double-check the numbers.

License

For the time being you can use the Visual Business Planner for free. It has a CC BY-ND 4.0 License.

This means, that if you take screenshots or if you make use of the Visual Business Planner in any other form you need to give credits and add the copyright field.

Disclaimer

You cannot hold the provider of this business planner liable in case any of the calculations are wrong, mismatching or based on false assumption. Be aware, that any planning is always a simplification of reality and any planning tool needs to make assumptions in order to reduce complexity. You are using the Visual Business Planner at your own discretion and risk and you need to perform your own quality assurance on whatever planning you are performing. If you are in doubt about its correctness, don’t use the Visual Business Planner. The Visual Business Planner also offers the function to Download the parameter values and essential time series. Please use this function to further apply your quality testings.

Confidentiality of Business Parameters & Plan Data

You do not need to worry about your secret business or product ideas, your confidential business parameters, or the generated business, customers or business plans. The Visual Business Planner does not collect any of your parameters, your generated time series or plans. Collecting the data without knowing what the product idea is would be pointless anyway. Technically, all the calculations are done locally on your device and not on a central server. Your business data do not go anywhere.

Add your Organization’s Name to the Business Planner

If you want to brand the Visual Business Planner with your organization’s name you can do so. The resulting logo then reads instead of Visual Business Planner → [YourOrg] Business Planner.

In case you would like to achieve this, please send me an email to prof.anders@online.de. Thank you.

Usage

Design Choices

-

The typical product design of many other business plan products is input to output: you have a form, where you put in some parameters, and then on another window you get your result. The Visual Business Planner is designed in a slightly different manner. The input of the parameters is directly into the output window. So, there is no separate input form. This design choice has several advantages: you only work in one window, you see the immediate response from your parameter changes, and you can take a screenshot at any time and will always have all the parameters you used in the picture. The disadvantage is, of course, that we are a little confined in space and therefore need to use some abbreviations.

-

If you hover with the mouse over the parameter names, you will get explanations. If you hover over the graphics you can read of individual data points.

Display Size

The Visual Business Planner is responsive. This means it will change its appearance dependent on the size and direction of your display.

Due to the limited size of the display, some functionalities cannot be offered on a smartphone. You need to have at least a tablet to get access to most functions.

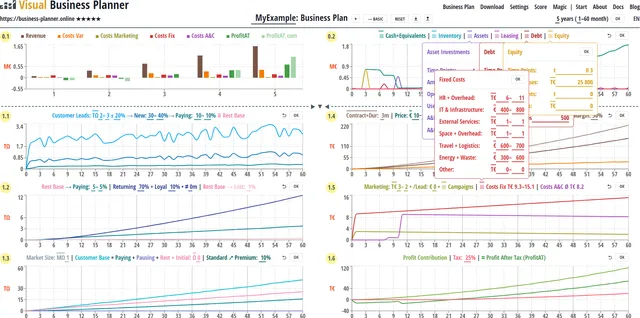

The Visual Business Planner is best used and viewed on a wide screen with a resolution of at least 1600 pixels. At this resolution the Visual Business Planner shows two columns in the ADVANCED mode which is best to get maximum overview. Most screens have this resolution. On smaller screens you can achieve this if you zoom out to a percentage that is lower than 100%.

To improve the interaction with the Visual Business Planner it is recommended to use the Full Screen mode. Normally, you can enter into it with Fn 11.

Symbols, Units & Dimensions

-

Ω is the symbol used here to denote 1 person. The reason why Ω was chosen is, that there is no universally agreed symbol for people. I chose Ω, because the Ω resembles a head with shoulders.

-

Π is the symbol to denote 1 product, piece or purchase. Π (Pi) is the greek letter for the uppercase P.

-

For currencies, the default symbol is €. However, you can chose your currency under Settings.

-

Most symbols are clickable. If you click on the symbol it enters the next dimension, e.g. from Ω → TΩ → MΩ → Ω or € → T€ → M€ → €. You can tell that a switch is available, when you see an overline and the mouse pointer is turning into an index finger on hover. In some cases not all dimensions (-, T, M) are available. The reason for this is that I did not see a use case. Please let me know otherwise.

-

T = Thousand, M = Million, B = Billion.

-

Also, note, that the dimensions of the y-axes of charts change. The dimension of Billion is not offered on symbols but may appear on a y-axis as needed.

-

In the ADVANCED mode there are three triangles: ▶︎, ◀︎, and ▼︎. The left and right facing triangle open a so-called drawer that helps you to display the value of one particular time series that you can pick. Clicking on the down-pointing triangle ▼︎ will open a section with Valuation, Ratios & Analysis and the Balance Sheet.

Input Fields

-

Input fields are underlined. When you click on one of them it widens in order to facilitate the input of a new parameter. After the input you can hit

Enteror press theOKbutton at the end of the line. -

To model a development or change of a parameter from the first month to the last months of your chosen time horizon, a number of parameters offer two input fields. For instance, you could assume that your new customers grow from 100 to 1000 of the time horizon. If the parameters for the first and last months have the same value, it is sufficient to only enter the first month and the last months changes automatically to the value of the first month.

-

If you click on the sign between two input fields (which is initially a ’–’) you can toggle between a linear and an exponential development from the first to the last parameter value. However, you will only see a curve if the parameters for the first and last month differ significantly.

Input & Number Formats

-

Most numbers must be input as integer values, that means without decimals.

-

Some fields that require a more fine grained planning are an exception to this rule: product prices, product (unit) costs, other income per paying or non-paying customer, costs per customer, marketing costs per lead, marketing costs per conversion, and customers lost.

-

Decimal numbers can have maximum 1 decimal. Decimals need a point and not a comma.

-

Many numbers have a maximum of 9999. If you want to go beyond this number change the dimension by clicking on the unit symbol and continue from there. You see that the unit symbol is clickable, if there is an overline on top of it. Most unit symbols are clickable.

-

Number fields in the cash chart allow for a different input format, as here inputs relate to certain time points. Different time points can be space-separated or comma-separated.

-

Subsequent inputs with corresponding information to the time points can than also be input in a space- or comma-separated format. If a subsequent field has less space- or comma-separated numbers than the corresponding time point field the in each case last number is used to replace all the missing ones.

Output Numbers Rounding

-

All data in the time series are rounded to the nearest integer.

-

Note, only when you use very small numbers of customers (<10) in connection with very low prices (<10), you may experience rounding effects. All other times you won’t notice.

BASIC vs. ADVANCED Mode

-

Click on the → ADVANCED button to enter the ADVANCED mode. All of your parameter values will be carried over.

-

Click on the → BASIC button to enter the BASIC mode. All parameter values available in the BASIC mode will be carried over. The non-available ones will be reset to default values.

-

Read more about the two modes in the BASIC vs. ADVANCED Mode section.

LEARN Mode

-

The LEARN mode is only available in the BASIC mode.

-

Click on the → LEARN button to enter the LEARN mode. In this mode you can familiarize yourself with the basic parameters, their meaning, the way to enter the parameters and some more functionalities of the Visual Business Planner.

RESET

- If you click on the → RESET button, all parameter values will be reset to zero or their default values. This is a great possibility to start all over again. But be careful there is no UNDO possibility.

MORE PRODUCT LINES

-

You can enter the MORE PRODUCT LINES mode by clicking on the ’+‘-button next to Business Plan in the title page. As a result an extra line with the name of the product line becomes visible. You can have a maximum of three separate product lines.

-

Be careful, the MORE PRODUCT LINES mode comes with extra complexity. Please read more about it in the section below.

Settings

Currently you can make the following settings.

-

You can change the color scheme in case you either do not like the colors and their combinations or in case the current color scheme does not fit to your company colors or presentation style. The basis for the chosen colors are Google’s material colors.

-

The following reasoning was guiding the current color choices:

- The darker the lightness the same color in a graph is the more relevant the corresponding variable typically is.

- blue & violet: assets (incl. customers) or asset connected

- brown & green: good, e.g. revenue, equity, price

- red & orange: bad, e.g. costs, debt, lost

-

You can set the currency symbol.

-

Leads for new customers will occur with some uncertainty. To reflect this you can generate some randomness in your customer leads. To make sure that always the same random numbers are generated, you need to start the generation with a defined, so-called seed. Just choose your individual integer number and you will always get the same random number sequence.

-

You can perform a factory reset. In order for you to start your work where you left it the last time, the Visual Business Planner is storing your parameters locally in the storage of your browser. If you want to clean all locally stored data, click on the ‘Factory Reset’ button.

Languages

The default and reference language of the Visual Business Planner is English. In addition, German is offered as an alternative language, but only for the Business Plan page and neither for the header, the footer or any other page. More languages may be added later on or on request.

Download & Upload

In order for you to share your business plan with others, you can download a file with all parameters by clicking on the arrow-down button in the header line. If the file is not modified it can then be uploaded again with the arrow-up button to re-generate all your time series and your business plan. Note: this function requires at least a small screen sizes of 992px and a landscape orientation und, thus, excludes most mobile devices.

Alternatively, you can also download the resulting time series or your business plan into a CSV-file to further use it in a spreadsheet. The chosen parameters are also displayed in this file for reference purposes, but this file cannot be uploaded again.

Hash Code

A hash code is a unique code that is generated to represent a set of data. The Visual Business Planner calculates a hash code for the whole parameter set and displays it in the bottom right corner. Whenever there is a change in the parameter set of the Visual Business Planner the hash code is recalculated. Two parameter sets that are the same have the same hash code.

BASIC vs ADVANCED Mode

BASIC Mode — Start Easy

-

There are two types of modes: the BASIC and the ADVANCED mode. For a more sophisticated planning you will probably need the ADVANCED mode. However, as the ADVANCED mode offers more options, it comes with additional complexity.

-

So, to have an easy start or in order for you to try out some first ideas without all the details the Visual Business Planner offers a BASIC mode.

-

The BASIC mode also provides extra input boxes as alternative input forms. This is meant to help you to familiarize yourself with the behavior of the business plan on parameter changes. These alternative input boxes are not available in the ADVANCED mode.

- You can switch between the BASIC and the ADVANCED mode. If you switch from BASIC to ADVANCED all your parameter values will be taken over. If you switch from the ADVANCED to the BASIC mode, you may lose some parameter values, because for the BASIC mode to function, the Visual Business Planner needs to reset some values which are not available in the BASIC mode.

ADVANCED Mode — Have Many More Possibilities

You can go pro with the ADVANCED mode. In this mode there are many more options and possibilities to model even complex business models. With some practice you will notice how fast you become with the Visual Business Planner. The idea is to keep complexity under control by having (a) everything on one screen: parameters, graphs, results, numbers and ratios and (b) by using charts and graphs wherever possible.

ANALYSIS of RATIOS and planning of CASH FLOWS:

-

Break Even, Equity Burn Rate, Growth, ROE, Profit Margin.

-

Equity Value, Free Cash Flows, Balance Sheet development.

-

Cash development, equity increases and dividend payments.

-

Debt increases or leasing contracts.

-

Investments into operating assets (e.g. PPEs or software).

-

Assumptions about accounts receivables and payables.

More options on PRICING for planning REVENUE:

-

A premium product with its own price and costs as an alternative to the standard product.

-

A subscription contract with a definable duration as alternative to a purchases.

-

Business models that are based on existing customers, e.g. freemium models.

-

Other income from customer base, e.g. from ads.

-

A trade margin for distributing your products through third party channels.

Advanced options for planning & segmenting CUSTOMERS:

-

Customer leads or new customers trough marketing, campaigns or network effects.

-

Conversions: Customer leads → new customers → (premium) paying or rest base. Rest base → paying. Paying → returning.

-

Development of customer basis: paying, pausing, or non-paying customers.

-

Market size as a reference.

More options for planning COSTS:

-

Marketing costs in general, per potential customer, per lead or for campaigns and per conversion therein.

-

Fixed costs broken down into costs for HR, IT, infrastructure, space, external services, travel, logistics, energy, waste, and other.

-

Costs and payments resulting from assets & capital: depreciations, amortizations, interests or payback payments.

-

Costs per customer.

MORE PRODUCT LINES Mode

-

Your business model may require more than one product line. This is for instance necessary for platform business models that distinguish between a buy and a sell side. Other business models may generate their income from a secondary income stream: e.g. the primary product is for free but the data generated from the first product will be used in a secondary mode. Again other business models may offer the some product but for different customer segments such as B2C or B2B. Of course, there are many more possibilities.

-

For all these cases and more the Visual Business Planner offers up to three product lines. The results of all individual product lines are automatically added up in the summary chart.

-

You can enter the MORE PRODUCT LINES mode by clicking on the ’#’ next to the Business Plan in the title page.

-

You will then get a new line in which you can enter the name of your product line. Also you get Plus and Minus buttons for creating or deleting additional product lines.

-

But working with more than one product line comes with additional complexity, so this is why it is a little bit hidden. The MORE PRODUCT LINES mode works in both the BASIC and ADVANCED mode. It is recommended to use the MORE PRODUCT LINES mode only after you feel comfortable to use the SINGLE PRODUCT LINE mode.

-

One of the additional requirement from working with MORE PRODUCT LINES is that you have to set cost ALLOCATIONS.

-

Typically the fixed costs of a company and the costs resulting from Assets & Capital (e.g. depreciations, amortizations or interests) are overall costs to the company. They, therefore, need to be allocated to the individual product lines for the consideration of the profitability of this product line.

-

When you are creating a new product line, all of the fixed costs and costs from Assets & Capital are equally spread across all product lines.

-

Of course, you can change this and allocate the different cost types according to your needs.

-

You always need to distribute multiples of 100%. If you distribute less, the last product line will get all the percentages that remain.

-

Whenever you give an allocation of less than 100% to the cost type of one product line, this cost type is multiplied with this allocation. The parameters stay the same but the resulting time series are changing. Also the corresponding figures in the summary bar graph are also adjusted correspondingly.

-

Because an allocation of less than a 100% means that the fixed or A&C costs are spread across two or more product lines, the cost base needs to be the same. The base for A&C costs is the same anyway, because these costs result centrally from planning assets and capital. For fixed costs any change in any of the product lines is synchronized with the fixed costs of all other product lines that have an allocation of less then 100%.

-

Whenever you give an allocation of 100% of fixed costs to one product line, you can plan these fixed costs individually for this product line. This is why you can also give 100% to more than one product line.

Business Logic

This section contains a description of the business logic, especially for the ADVANCED mode. In the BASIC mode, most parameters may be hidden but the business logic for those parameters and options which are available is absolutely the same.

Business Plan, Time Horizon & First Month

The objective of every business plan is to understand:

-

The Profit After Tax over time.

-

The Break Even Point or other performance ratios.

-

The Customer Base development.

In order to see where the Profit After Tax or the Break Even Point result from, a business plan typically also shows the:

-

Revenue.

-

Variable Costs.

-

Marketing Costs.

-

Fixed Costs.

-

Costs resulting from Assets & Capital.

The Time Horizon of a typical business plan is 5 years or 60 months. As an absolute minimum you can plan for 2 years. In general, business plans are not longer than 10 years.

Normally, a financial year starts in January. However, there are many companies which have a different financial year, e.g. from April to March. This is why the Visual Business Planner uses month numbers rather than month names.

Independent of when the financial year starts, your first operational months may not be the month 1. For this case you can choose the First Month in your first financial year.

Independent of the profit situation it is important to plan the cash development of your business. Running out of cash and the inability to get new capital into the company is the prime reason for insolvency.

The cash of a company is positively impacted by:

-

Revenue

-

Equity increases

-

Debt increases

-

Accounts Payable (based on agreed credit periods)

The cash of a company is negatively impacted by:

-

Variable Costs

-

Marketing Costs

-

Fixed Costs

-

Accounts Receivable (based on agreed credit periods)

-

Inventory

-

Inventory fix and unit costs

-

Investments into assets

-

Investment fix costs

-

Re-payments of debt

-

Interest and lease payments

-

Dividend payments

The cash of a company is not impacted by:

- Depreciations or amortizations

Business Plan Elements

Product:

-

Product: The product is what you offer and what you ask the price for.

-

Price: The price is what the paying customer pays per transaction for the product.

-

Premium Product: You can have a standard product and a premium product and you can ask different prices for each.

Purchase or Contract:

-

The combining link between a customer and a product is a Purchase or Contract.

-

Purchase: In a purchase the customer gets the product and pays the money. This is a single transaction.

-

Contract: A contract is the basis for several transactions that take place within this contract. It is important to understand the concept of a contract. A contract can be one transaction per month or it can be a subscription that has a longer duration. In each month of the contract duration there will be one transaction.

-

As long as the contract runs, the customer is a paying customer. Once the contract ends the customer is not longer a paying customer unless the customer returns for another purchase or contract.

-

HINT: Click on ‘Purchase’ or ‘Contract+Duration’ to choose between them.

Market Size: This field is only for informatory purposes and to compare it to the Customer Base for instance. It is always good to know the size of the market and any investor will ask for this. A change in the market segment does not change any computation.

Customers: The key to making a financial and marketing plan is to put the customer into the centre. There are two primary customer segments: new customers and existing customers. In your business model you need to decide if the focus is on selling to new customers, to existing customers or to both groups because your marketing efforts and customer interaction will differ. The Visual Business Planner helps you with planning the customer development in detail by using the following customer segments:

-

Customer Leads: Potential customers who come across your business, either online or physical and who show interest in your product one way or another.

-

Customers New: Customers that your company “knows” now, because maybe they have signed in into your shop, database, app or platform. However, they are not paying customers yet. Hint: In case the new customers are not known by the company and convert straight from customer leads to paying customers, leave the percentages of Customers New at 100%.

-

Customers Paying: Customers who are paying for your product.

-

Customers Rest Base: The customers that are not paying wander down into your company ’⇓ Rest Base’. You can later try to convert ‘Rest Base’ customers into ‘Paying’ customers. If your company does not keep the non-paying new customers in a database, you can click in the ’⇓‘-symbol and prevent that a ‘Rest Base’ is built.

-

Customers Pausing: Customers who have already paid for your product and will buy it again, but only after a certain period. In this interim period the customer is considered a pausing customer. The reason for the pause is, that sometimes another purchase of the same product is not immediately needed.

-

Pausing Months (≠): The period that a previously paying customer is pausing before returning. Revenue is stronger if the pausing months are as short as possible.

-

Returning Customers: Customers who return from the group of paying customers and purchase again.

-

Lost Customers: Some customers loose interest in your product and sign off of from your shop or platform. This is independent of whether or not they were paying for your product previously. These customers are customers lost and they reduce your customer base. The number of customers you loose in a month is applied to the Customer Rest Base from the previous month since they are non-purchasing at the moment.

-

Premium Customers: If you offer a premium product, some of your paying customers may choose to switch from the standard to the premium product. Customers with the premium product are still part of the Customer Base Paying.

Conversions: In order to maximize the sales of your product you need to manage the flow of customers. The buzz word is conversion. Here are all the conversions offered in the Visual Business Planner:

-

Leads → New: Potential customers that are converted into new (but not yet paying) customers. All new customers are added to the Customer Base. HINT: If you do not have non-paying customers, you can set this conversion rate to 100% and with this jump over it.

-

New → Paying: Customers that are converted from new to paying customers. Customers that are paying will count as paying customers. Customers that are non-paying will be added to the Customer Base Rest.

-

Rest Base → Paying: Customers that are converted from the rest base to paying customers. In this case customers are moved from the Customer Base Rest to the Customer Base Paying.

-

Returning: Customers from the paying customer base that are returning and purchase again. HINT: The behavior is recursive, e.g. if the parameter is 10%, then from 100 paying customers return 10 and from these 10 customers 1 returns.

-

Loyal: Customers from the Customer Base Paying that are returning. Once they have returned they will continue returning and purchasing forever.

-

Rest Base → Lost: customers that are lost. Customers are lost from the Customer Rest Base. Building up a large customer base is important if one not only wants to sell to new customers. Therefore, it is recommendable to try to lose as few as possible customers. But it is unrealistic to plan that no customers will be lost.

-

Active ↗︎ Premium: a customer who is convinced of your product may switch from buying the standard product to buying the premium product. The assumed behavior of the premium customers is otherwise the same as the one of the standard product.

Revenue:

-

External Revenue: External Revenue = Price × Units sold. Units_sold equals the amount of paying customers per months.

-

Internal Revenue: If you have help in selling your product either through a store (chain) or third party sales people, you have to normally pay a trade margin, commission or give rebates.

-

Other Income from Customers: You may use your access to your customers for other sources of income, e.g. sending them advertising. Other income is generated from the whole customer base.

Variable Costs:

-

Variable Product Costs: Physical products have unit costs attached to it. The variable product costs are the sum of all unit costs times the number of sold products.

-

Variable Customer Costs: Independent of the variable product costs, in some cases there are also costs for holding and administering the customer base. They are variable because they vary with the amount of customers.

Marketing Costs. You have principally three types of marketing costs:

-

General Marketing Costs that you choose to expend every month for general marketing purposes.

-

Variable Marketing Costs which are also called customer acquisition costs, if you pay an amount per individual customer lead.

-

Marketing Campaign Costs. A campaign has a start month and a duration. You need to estimate how many additional monthly customer leads or conversions will be generated for an additional amount of money that you will expend per month over the time of the campaign. You can access the campaign parameters by clicking on the ≣-symbol.

-

Marketing Campaign Conversion Costs: It is assumed that you can only influence the following conversions by help of a marketing campaign: Leads → New, New → Pay, Rest → Pay, Returning. You can specify a cost which will be the same independent of the type of conversion. That a customer becomes loyal cannot be achieved by help of marketing.

Fixed Costs:

-

Fixed Costs are all costs that you expend regularly on a monthly basis. Some people call them anyway-costs because they occur anyway, which means independent from how much revenue you make.

-

Typically, fixed costs are comprised of costs for HR, IT or infrastructure, external services, space or rent, travel expenses or logistics, energy or waste, or other fixed costs.

-

Some fixed cost types come with overhead. Overhead are additions to the cost type. E.g. HR costs are salaries. Overhead on HR costs are social security contributions that come on top and that you have to give to the state. Overhead on space are the running costs of being in the space, such as insurance, heating, cleaning or maintenance.

Costs resulting from Inventory:

- There are Inventory Fix Costs and Inventory Unit Costs. They are described under Inventory. Principally, they could be planned also under the cost section. However, planning them under inventory has the advantage of easier allocation across product lines.

Costs resulting from Assets:

- There are Asset Fix Costs. They are described under Assets. Principally, they could be planned also under the cost section, however, planning them under Assets has the advantage of planning the costs only for the useful lifetime of the asset and for easier allocation across product lines.

Costs resulting from Capital.

-

Capital: Capital is what is needed in order to fund a company. There are different forms of capital. The most important ones are equity, debt, and leasing. Equity capital reflects the ownership of the company.

-

Cost of Capital: Equity capital does not immediately lead to payments, but investors that have an equity share in a company will expect that the business eventually makes profits so that the value of the company goes up. Also profits are the basis for dividend payments to the shareholders. Debt and leasing result in interest payments.

Profit Contribution, Tax & Profit after Tax:

-

Profit Contribution: Profit Contribution is also know as Gross Profit. It is Internal Revenue minus all Variable Costs. Profit Contribution is an important concept. It is needed in order to see how much does the profit contribution of a product line contribute to covering the marketing, fix and A&C costs (allocations) of the company.

-

Profit after Tax: Profit is Profit Contribution minus all remaining costs, e.g. Marketing Costs, Fixed Costs as well as Assets & Capital Costs. In other words: Internal Revenue minus all costs.

-

Cumulated Profit before Tax: Sometimes, before a company becomes profitable it may take a number of years. The losses of these years are carried forwards and compensated with future profits. If you add all these profits and losses up over the years you’ll get the Profit after Tax Cumulated. The moment or year in which the Profit after Tax Cumulated turns positive for the first time is also named Break Even.

Taxes:

-

Gains Tax: Companies that make profits need to pay gains tax. Tax rates differ based on the taxable amount and how much is paid out as dividends or withheld. In addition to gains tax companies also often need to pay local taxes. Tax legislation is difficult and varies across countries. For simplification purpose the Visual Business Planner therefore offers an average Tax Rate only.

-

Tax Rate: All kind of different taxes are subsumed in the average Tax Rate.

-

Losses Carry Forward: Typically, losses in one year can be carried forward into the next year, so that companies only have to pay taxes for the netted amount in the next year. This assumption is also used in the Visual Business Planner.

-

Taxes per Product Line: If profit before tax is >0 then the approximated profit after taxes per business line are ≈ ProfitAfterTax = ProfitBeforeTax (1 - (TaxRate / 100). The final tax calculation is more complicated as it is based on annual values and allows for loss carry forwards. Hence, for monthly values per product line use the approximation. If you have more than 1 product line, the Profit Before Tax and subsequently also the Profit After Tax both depend on the allocations of the Fixed Costs and the Costs from Assets and Capital.

-

Tax on Company Level: As taxes are paid on company level, the overall taxes are re-calculated after accumulating the Profit Before Tax from the product lines. The re-calculated tax is then also the basis for the Tax Payments to the financial authority.

-

Tax Payments: Taxes are paid out to the financial authority typically 4 times a year. Visual Business Planner assumes that the tax payout dates are in the months 3, 6, 9, and 12 of the year for which the tax is due. For a proper calculation and to avoid adjustments of the quarterly tax payments Business Planner first calculates the taxes at the year end and then distributes this amount in 4 equal portions over the before mentioned dates. Note, the payout dates impact only the cash flow but not the profit.

-

Value Added Tax (VAT): Most companies have to put a VAT on their product and thus can deduce input VAT. In this case, VAT is not negatively impacting the business plan and therefore VAT is currently not offered in the Visual Business Planner. (VAT is only impacting the business plan if the VAT rate on the product is lower than the VAT rate the company pays for supplies or services received.)

Cash

-

Acc Receivable stands for Accounts Receivable. Receivables are the cash payments you should receive from your product sales. A portion of your receivables may be paid at a later period depending on the agreed credit period. The later you receive your cash payments the worse for your cash situation.

-

Acc Payable stands for Accounts Payable. Payables are the cash payments you need to pay to your suppliers. A portion of your payables may be paid at a later period depending on the agreed Credit Period. The later you make your cash payments the better it is for your cash situation. If Payables are parameterized they are applied to the typical external expenses: Order into Inventory or External Services (specified under Costs Fix).

Inventory

-

Inventory: Some business models require inventory, e.g. when products need to be pre-produced or purchased. The products are then put into inventory and sold out of inventory. The capital needed for the pre-production is part of the so-called (net) working capital. Inventory management is a subject in itself. As the Visual Business Planner is focusing on the business planning it, therefore, needs to take some simplifying assumptions to keep the complexity manageable.

-

Inventory Demand for: Visual Business Planner assumes that you exactly know the demand in the future (as you modelled it with your parameter input). Visual Business Planner lets you specify how many month worth of sales you want to have in the inventory.The idea is then to stock up inventory and sell it all off before you re-stock it and so on. (The amount of re-stockings per year is know as inventory turnover.) The default value for ‘Demand for’ is ‘1’. That means you will never have inventory in the balance sheet because you use everything up in the same months (or you do not need inventory in the first place). If you choose a value ‘>1’ it means that you are ordering into inventory an amount of products to satisfy the demand for the specified amount of months. You are then selling out of inventory. The inventory is stocked up at product costs from the time point you stocked it up.

-

Inventory Lead Time: Lead time is the period between when you have filled up the inventory and before you actually start selling from it. ‘Lead Time’ must be smaller then ‘Demand for’. Example: ‘Lead Time m 2’ means that you filled up inventory two months before you are starting to sell from it.

-

Inventory Fix Costs: These are the costs for managing the inventory itself, such as maintenance, services, dedicated staff, etc.

-

Inventory Unit Costs: These are the costs per unit in the inventory. They are incurred e.g. through individual fees, loss in value, pilfering, damage, losses etc. As ‘Inventory Unit Costs’ are calculated on a monthly basis, they are requested as permil value (‰).

Assets:

-

Typical investments of businesses are into physical assets (such as machines) to produce something or into larger software solutions or developments as a basis for a product or service.

-

Asset Investments: An investment is cash spent for a tangible (e.g. machine) or intangible (e.g. software) asset. You can pick the time points at which investments are planned to take place and the amounts to be invested.

-

Asset Operating Costs: Costs that result from a specific asset, e.g. for maintenance, care etc. The cost are only incurred over the useful lifetime of the asset.

-

Useful Lifetime: Each asset has a useful lifetime over which the asset is used. During this lifetime the asset is losing value which is the basis for calculating depreciations or amortizations.

-

Amortization & Depreciations (A&D): When companies invest into their operations they have to distribute the investment amount over the so-called Useful Lifetime (ULT) of the investment. These distributed costs are called depreciation for physical assets and amortization for intangible assets. Thus, companies only need to book a fraction of the investment every month as expenses into their Profit & Loss (P&L) account. There are two different methods to calculate amortizations and depreciations. 0 stands for the linear method, 1 for the double declining balance (DDB) method.

-

Double Declining Balance (DDB): This is a method for accelerated amortization or depreciation. The DDB method amortizes or depreciates assets twice as fast as the linear method. The calculation is: Depreciation / year = 2 × LinearDepreciation / year and Depreciation / month = Depreciation / (year × 12)

-

A&D On Hold: In some special cases, companies can delay the depreciation or amortization if, for instance, the asset purchase or development is not yet finalized.

Leasing:

-

Leasing: Leasing contracts are amongst other things advantageous when you are not having or if you cannot get enough cash for buying an asset. The Visual Business Planner assumes that all leasing contracts are Finance Leasing as opposed to Operating Leasing. Conceptually, Finance Leasing can be considered as loan for a lease object, where the lease object serves as collateral.

-

Payments: In a finance lease contract you (the lessee) agree with the lessor a regular (monthly) lease payment for the duration of the contract.

-

Leasing Present Value (PV): The liability amount with which you need to balance the leasing contract results from a present value calculation using the agreed lease payments, the duration of the contract and the average funding interest of your company. Typically, the Weighted Average Cost of Capital (WACC) is chosen.

-

Visual Business Planner assumes that at the end of the contract the lease object belongs to the lessee. For book keeping the lease payment is split into two parts: one part of the payment is for the repayment of the underlying loan and it is booked against the Leasing PV. The other part for the interest is an expense to your company and reduces the profit.

-

Leased Asset: The Leasing PV at the same time becomes the asset value of the Leased Asset. This Leased Asset value minus a remaining salvage value must be depreciated over the useful lifetime of the lease object. For simplification purposes the Visual Business Planner assumes a salvage value of zero.

-

Depreciation Method: There are two different methods to calculate depreciations. 0 stands for the linear method, 1 for the double declining balance method. (See definition of this method under Assets.)

Debt:

-

Debt: Debt is capital that investors (e.g. bank, financial market participants) borrow to your company. You can pick the time points at which you plan to lend the debt amounts .

-

Durations: Money is borrowed for a certain period.

-

Types: There are many forms of debt contracts. Amongst other things they differ in the way the principal is paid back. The Visual Business Planner offers two types: 0 stands for an annuity contract in which the payback amount and the interest payment are distributed as equal payments over the duration of the debt contract. 1 stands for a maturity contract where the principal only needs to be paid pack at the end of the life time. In this case, only interest payments need to be made in each month.

-

Interests: Agreed interest rates for the debt contracts noted in basis points (bps). 100 bps = 1%.

Equity:

-

Equity: Equity is capital invested into your company in exchange for a partial ownership of your company. You can pick the time points at which the equity increases take place.

-

Dividends: When you the company had a successful year and also has enough cash it can choose to pay out dividends. For this, select the corresponding time points and dividend amounts.

Network Effects

Network effects occur, when your existing customers bring extra customers that come on top of your marketing efforts. This can happen when your existing customers bring extra customers, for instance, through recommendations. This can also happen, when you get organizations as customers which then also bring the people connected to them as extra customers to your company. The mechanism behind network effects is that the value-added per customer increases the more customers use the product. So there is an inbuilt incentive for each customers to bring more.

You can only access NETWORK EFFECTs, when you are in the ADVANCED MODE and there in the MORE PRODUCT LINES MODE.

NETWORK EFFECTs are another very powerful feature of Visual Business Planner, but like always, powerful features add some additional complexity.

HINT: NETWORK EFFECTs add extra customers to Customers New. You can try out how the effects work, if you are using, say, Customer Leads: Ω 100 and Leads → New: 100 – 100% in product line 1 and 2 and then apply various network effect parameters. You will then see how the Customers New line in the corresponding chart changes.

Using Network Effects

-

Notation: NΩ : XΩ / Period in months, where\ NΩ = New Customers\ XΩ = Extra Customers\

-

Example: 10 : 1 / 12m, means that 10 new customers will bring 1 extra customer over a period of 12 month. No extra customer is brought after this period. If you want to achieve that extra customers are also brought after 12 months, you can, for instance, specify 10 : 5 / 60m, which means that 10 new customers will bring 5 extra customers over a period of 60 months. Of course, you can also have multiplier effects, such as 1 : 10 / 12m, which means one new customer will bring 10 extra customers over a period of 12 months.

-

As extra customers are also new customers, they obviously bring extra customers themselves.

-

NOTE: Because network effects are calculated recursively, the computation of parameter effects may take a little longer than the computation of the other parameter effects.

-

Switches: In order to change the behavior of NETWORK EFFECTs and make this visible, you have three symbols. Click to switch between them.

-

[⇍] Switches the network effect OFF for THIS product line but not for the others. Each product line has its own switch.

-

[⇐] Network effects apply in THIS product line. Customers New of this product line bring extra customers into the SAME product line. This is useful, for instance, for recommendation or social pressure effects. This effect applies to all new customers from THIS product line and the one potentially added from a product line BELOW if the switch of the product line BELOW was set to ⇑.

-

[⇑] Network effects apply to the product line ABOVE. Customers New of this product line bring extra customers into the product line ABOVE. This is useful for modelling multiplier effects. This switch will bring extra customers into the product line above even if the switch of the above line is set to ⇍.

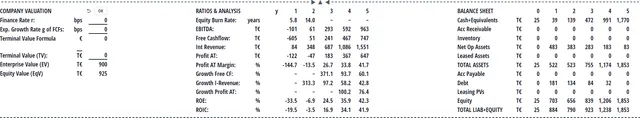

Valuation, Ratios & Performance Analysis

Every company has a value. This value results from the performance of the company and its development in terms of profits, revenues or customers. Visual Business Planner supports you with the analysis through some essential ratios. The value of the company can additionally be influenced by factors such as future potential, market positioning or moat. Visual Business Planner factors this in by giving you the freedom to input your own reasonings (e.g. by determining your own multiples).

In the ADVANCED mode you can enter the analysis section by clicking on the black triangle ▼︎.

Value

-

Free Cash Flow is the cash flow generated from the operations of the business after adjusted tax and before interest payments minus CAPEX. Free Cash Flow is a very useful figure because it shows what amount of cash is generated from the operations of the company.

-

CAPEX stands for Capital Expenditure and it is the amount of cash that is invested into the operations of the business per year.

-

Enterprise Value: The Free Cash Flows (FCFs) are the basis of Discounted Cash Flow (DCF) models which help to establish the Enterprise Value of the company. The Enterprise Value is calculated as PV = PV(Finance Rate, FCFs, Terminal Value), where PV stands for Present Value.

-

Equity Value: The Equity Value results from the Enterprise Value by subtracting the liabilities (Debt and Leasing) and by adding Cash.

-

Terminal Value: A company generates FCFs even after the chosen time horizon of the business plan. All the FCFs generated thereafter are subsumed in the so-called Terminal Value. The calculation of the Terminal Value is based on the reasoning of a lifelong perpetual annuity. To calculate the Terminal Value (TV) one uses the FCF from the last year, a Growth Rate g for the FCFs, and the Finance Rate r of the company. The formula from the valuation theory for calculating the Terminal Value is: TV = FCFlast × (1+g) / (r−g). Note, that r > g.

-

Balance Sheet: The Balance Sheet shows you the status-quo of the company at the end of each year of your business plan. Some of the ratios for performance analysis refer to Balance Sheet positions.

Ratios & Analysis

-

Year: The index y stands for year.

-

Break Even: BreakEveny = ProfitContributiony / (CostsMarketingy + CostsFixedy + CostsA&Cy)

-

Equity Burn Rate: If ProfitATy < 0 then EquityBurnRatey = Equityy / | ProfitATy | else 0.

-

EBITDA: EBITDAy

-

Cashflow Operations: CashflowOperationsy = ProfitATy + Depreciationy - ΔInventoryy - ΔAccReceivabley + ΔAccPayabley

-

Free Cashflow: FreeCashflowy = CashflowOperationsy − CAPEXy

-

Profit After Tax Margin: ProfitATMarginy = ProfitATy / Revenuey

-

Return on Equity: ROEy = ProfitATy / ((Equityy-1 + Equityy) / 2)

-

Return on Invested Capital: ROICy = Nopaty / ((InvestedCapitaly-1 + InvestedCapitaly) / 2)

-

Nopat: Nopaty = Ebity - Taxy

-

Invested Capital: InvestedCapital = LeasingPV + Debt + Equity

-

Finance Rate r: Average rate for financing the company (WACC is often used).

Roadmap

The Visual Business Planner should allow to plan for most business models up to a certain level of complexity. If you are missing a functionality or behavior, please, check out the Roadmap. If you cannot find the desired functionality or behavior there, you may want to send me an email: prof.anders@online.de. Thank you.

Here you will find the features of the Visual Business Planner that I have currently planned to implement for an upcoming version.

-

Enter historical data.

-

Blog — writings on business plan topics, such as Break Even, Cash Flow, Ratios, Taxes.

-

Screen cams for video explanations.

-

Switch whether losses can be carried forward?

-

Generate PDF. For the time being you may want to try out Fireshot, which is a tool for generating screenshots and PDFs from webpages. But you need to judge for yourself. There is no connection between Fireshot and the Visual Business Planner so we have no further insights into this tool.